28+ Borrowing expense calculator

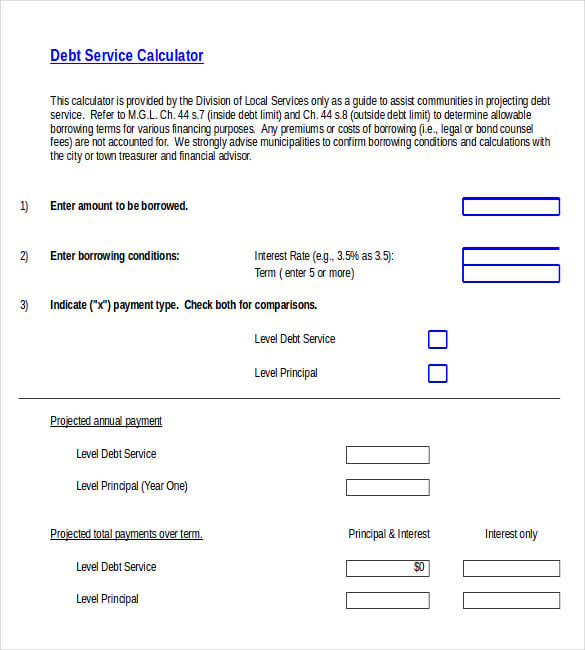

The Mortgage Calculator provides an overview of how much you can expect to pay each month including taxes and insurance. Housing NSW estimates the following borrowing costs and explains what factors influence these expenses.

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

You can borrow up to 381000.

. Borrowing Power Calculator 28 Shares Borrowing Power 1 Your income details Salary Net Monthly Other Income Gross Monthly I have a partner 2 Your expense details Dependants 0 1 2. Eligible Borrowing Cost Actual Borrowing Cost Income from temporary investment of funds. Multiply that number by the remaining loan balance to find out.

Unemployed this is a private expense borrowing expenses on any portion of the loan you use for private purposes for example money you use to buy. How much to put down. To calculate the amortized rate you must do the following.

The APR is the stated interest rate of. The term of the loan. The borrowing Power total is calculated at the greater of the Interest rate input a buffer of 3 or a fixed floor rate of 575 The greater of the estimated Living Expenses input or a default.

The calculation will be as follows. This basic APR Calculator finds the effective annual percentage rate APR for a loan such as a mortgage car loan or any fixed rate loan. 3000 398 Yr 1 600 Yr 2 2002 Yr 3 In other words Paul will claim a borrowing costs deduction of 2002 in his 2018 tax return.

Instead of opening two Borrowing Capacity calculator. Our borrowing power calculator will estimate how much you could borrow and what your loan repayments will be so you can figure out if our ubank home loans suits you. Use our interest rate calculator to see how interest rates affect borrowing and saving.

For example it can calculate interest rates in situations. This means you can easily calculate borrowing capacities by either adding or suppressing it from the income total. 40000 9 3125 Eligible Borrowing Cost 32875 W3.

While 20 percent is thought of as the. Where your total borrowing expenses are more than 100 you spread the deduction over the shorter of either. How to claim borrowing expenses.

Divide your interest rate by the number of payments you make per year. How to use our calculator Choose how much you want to save or borrow. Interest Rate Calculator The Interest Rate Calculator determines real interest rates on loans with fixed terms and monthly payments.

This estimates are also relevant for all other Australian States Territories. Enter the amount into the box.

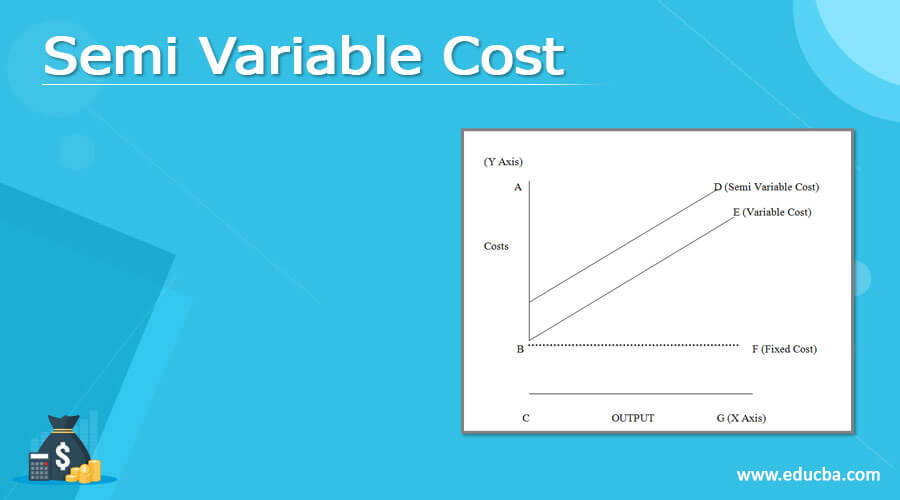

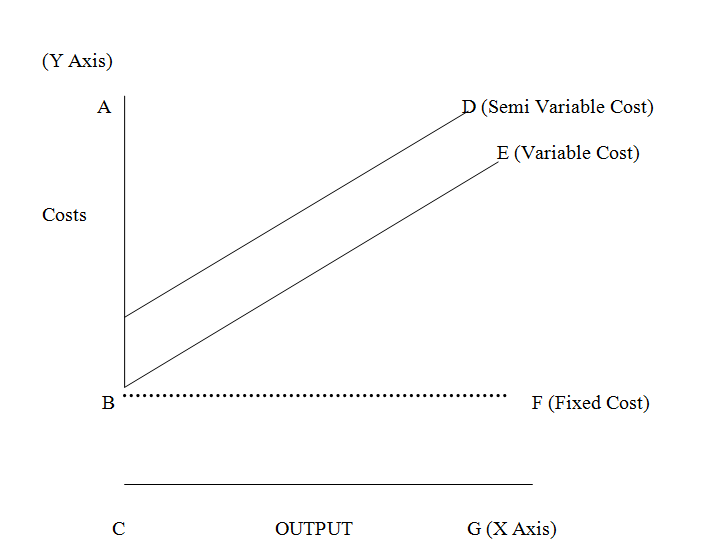

Semi Variable Cost Examples And Graph Of Semi Variable Cost

Ex992

Job Costing Complete Guide On Job Costing In Detail

Small Business Bookkeeping Template 8degrees Co Throughout Excel Templates For Small Busi Bookkeeping Templates Excel Templates Business Spreadsheet Template

2

Ex992

Ex992

Semi Variable Cost Examples And Graph Of Semi Variable Cost

Loan Syndication How Does Loan Syndication Work With Example

Ex992

Ex992

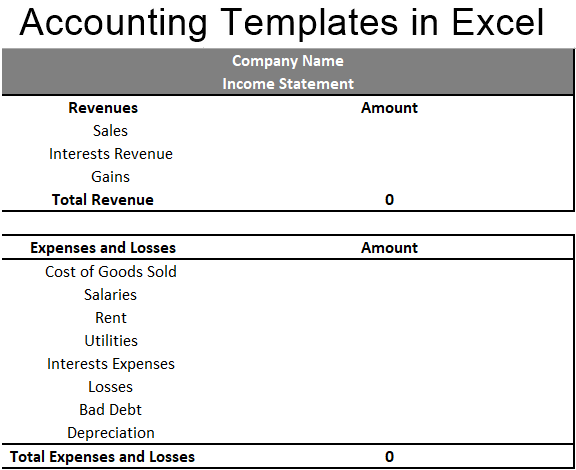

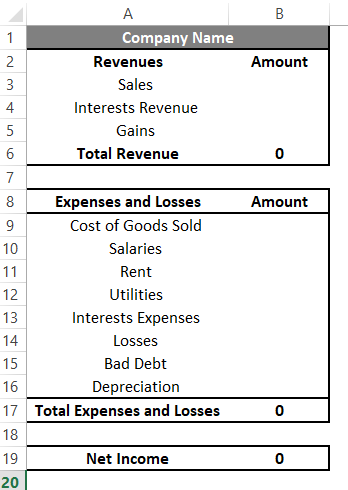

Accounting Templates In Excel Useful Accounting Templates In Excel

Accounting Templates In Excel Useful Accounting Templates In Excel

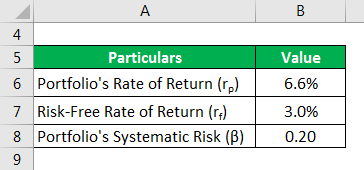

Treynor Ratio Examples And Explanation With Excel Template

Gauging Economic Activity It Takes Money To Make Money Seeking Alpha

Sample Service Order Template 19 Free Word Excel Pdf Documents Download Free Premium Templates

3